-

Music

Music

Interview: Joe Carnall Jnr

Joe Carnall Jnr is a household name in Sheffield. With his talents pouring out of, not one, but

-

Sport

Sport

After Dominating BUCS, Men’s Volleyball 1′s Take On Europe!

Sheffield Hallam’s men’s volleyball 1′s travel to Camerino in Italy later this month hoping to be crowned champions

-

Music

Music

Competition: Win Two Tickets to Tramlines 2015!

Written by Jess Peace Festival season is finally upon us. Taking over the city once again, Tramlines

-

Sport

Sport

Hallam Athletes To Represent Team GB At World University Games!

Two Hallam students will travel to Gwangju, South Korea in early July to represent Team Great Britain & Northern

-

Fashion

Fashion

Feisty and Fabulous – An Interview with Georgina Grogan

Georgina Grogan is just 20 years old and has already harnessed more than a few titles to be

-

Music

Music

Young Guns live in Sheffield

Young Guns ended their UK tour on a high with their first headline show in Sheffield for three

-

Music

Music

Interview: Joe Carnall Jnr

Joe Carnall Jnr is a household name in Sheffield. With his talents pouring out of, not one, but

-

Music

Music

Gig Review: Hozier at The Roundhouse

Words by Caitlin Black, Photo by Joshua Atkins It has been a crazy few years for the Irish

-

Film Reviews

Film Reviews

The Second Best Exotic Marigold Hotel – Review

Words by Dave Moxon The Best Exotic Marigold Hotel was a hit film in 2012, starting some

-

News

News

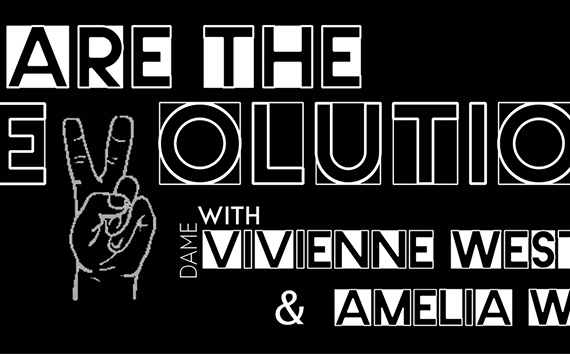

Vivienne Westwood joins forces with Amelia Womack to promote the Green Party in Sheffield

Fashion designer Dame Vivienne Westwood will be here in Sheffield next April to support the Green Party’s Deputy

-

Film Reviews

Film Reviews

Catch Me Daddy – Review

Words by Mike Atkinson The Wolfe brothers’ début is an astonishingly dark string of events collected together

-

Film Reviews

Film Reviews

Still Life – Review

Words by Bethan Tanner John May (played by the ever-excellent Eddie Marsan) is the man at the